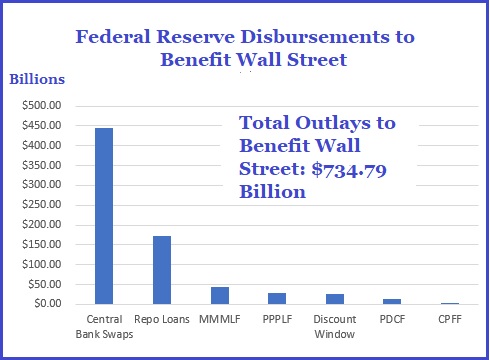

The Fed Hasn’t Spent a Dime Yet for Main Street Versus $735 Billion for Wall Street

Published: May 15, 2020

Share Source:

Wall Street On Parade

The stimulus bill known as the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) was signed into law by President Donald Trump on March 27. Among its many features (such as direct checks to struggling Americans and enhancing unemployment compensation by $600 per week for four months to unemployed workers so they could pay their rent and buy food) the bill also carved out a dubious $454 billion (or 25 percent of the

total $1.8 trillion spending package) for the U.S. Treasury to hand over to the Federal Reserve. This was the Faustian Bargain the Democrats had to agree to in order to get the deal approved by the Wall Street cronies in the Senate.

If you subtract the $454 billion from the

$1.8 trillion total spending package, that left $1.346 trillion for other purposes. But the $454 billion wasn’t really just $454 billion. It was going to be leveraged up by a factor of 10 to 1 into a $4.54 trillion bailout for Wall Street. This, effectively, meant that the CARES Act provided $1.346 trillion for average Americans and other purposes versus $4.54 trillion for Wall Street. In short, the assistance going to Wall Street was more than 3 times larger than that going to families and workers.

White House Economic Advisor Larry Kudlow, U.S. Treasury Secretary Steve Mnuchin, and Federal Reserve Chairman Jerome Powell had cooked up a scheme where the $454 billion would be handed over to the Fed, then split up into chunks, placed into Special Purpose Vehicles (SPVs) and then leveraged up by as much as 10 to 1 to provide bailouts to Wall Street. The $454 billion is being designated by the Fed as “loss absorbing capital,” meaning that taxpayers will eat the first $454 billion in losses on these Wall Street bailout programs.

Read More...Share This Article...